Join the Renewd community to grow your recurring revenue

• Subscriptions • Membership • Events •

Join the Forum for FREE Explore Premium Membership

3,000+ Members

3,000+ Members  Exclusive Content

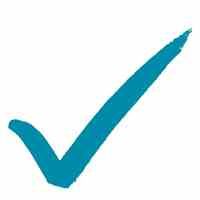

Exclusive Content  In person gatherings

In person gatherings

Join the Renewd community to grow your recurring revenue

• Subscriptions • Membership • Events •

Join the Forum for FREE Explore Premium Membership

3,000+ Members

3,000+ Members  Exclusive Content

Exclusive Content  In person gatherings

In person gatherings

Discover your benefits as a member

Join 3,000+ Information business specialists

Join 3,000+ Information business specialists  Learn from top Media/Event leaders

Learn from top Media/Event leaders  Attend in person networking gatherings

Attend in person networking gatherings

Renewd is 100% member-led. Choose the membership level that fits your goals best.

| Features |

Premium Member |

Free Forum Member |

| Access to the Renewd Forum - Our online community |  |

|

| Monthly newsletter |  |

|

| Online roundtables, case studies & webinars |  |

|

| Resource library of past webinar recordings |  |

|

| AI Strategy & Leadership Councils |  |

|

| Exclusive Leadership Retreat |  |

|

| Annual Summit US |  |

|

| In-person gatherings and networking UK |  |

"New connections, fresh perspectives, and a clearer view of the opportunities and threats we all face."

"New connections, fresh perspectives, and a clearer view of the opportunities and threats we all face."

- Alex Pratt, MD, Clarion Events

"There are no new ideas, just people that have done them before you."

"There are no new ideas, just people that have done them before you."

- Louise White, COO, Sift

"Honest, transparent dialogue... we have made some adjustments to strategy that are already yielding results."

"Honest, transparent dialogue... we have made some adjustments to strategy that are already yielding results."

- Richard O'Connor, CEO, B2B Marketing

"It's very actionable."

"It's very actionable."

- Betsy Nicoletti, Founder, CodingIntel

"I continue to learn so much from these amazing, brilliant individuals."

"I continue to learn so much from these amazing, brilliant individuals."

- Angela Kornegor, CEO, MedLearn Media

"A room full of experts"

"A room full of experts"

- John Hitchcock, VP & MD, Energy Intelligence Group

What Sets the Renewd Community Apart?

Together, we're focusing on the following:

Current best practices

Current best practices

The latest AI solutions

The latest AI solutions

Sales and marketing strategy

Sales and marketing strategy

New product strategy

New product strategy

Events as subscription growth drivers

Events as subscription growth drivers

Getting pricing and packaging right

Getting pricing and packaging right

Subscription metrics

Subscription metrics

Building new connections

Building new connections

Organisational structure optimisation

Organisational structure optimisation

January - ONLINE:

Reflect on AI's breakthrough moments from 2025 and explore what's ahead in 2026. Share and hear real-world success stories of AI implementation. Led by Jennifer Schivas, CEO of 67 Bricks.

Premium Members Only - Join us Wednesday, January 14, 2026.

February - ONLINE:

Renewd Leadership Council February Meeting - An exclusive peer-to-peer forum for global Renewd Premium Members.

June - WASHINGTON DC:

Renewd Summit -The essential annual gathering for senior leaders in B2B specialized media.